Community Report

Miikowap Business Development Corp

The 4plex has had a variety of unknown issues come to light over the year. One of the major repairs required was the collapse of the main line, a liner was installed that will resolve the problem for years to come. Still a heavy cost on a young business.

As the 2020 year ended, a waterline broke in the heating system and unfortunately, after nearly a month of delay, insurance provided a decline on the claim for repairs. The Trust needed to provide and equity injection as cash in Miikowap was low to due low tenancy as not all units were yet available until the summer of 2020. Payment of the repairs were incurred in January 2021.

As of Oct 2021, 4 units are completely rented and is expected to have a positive cashflow in the year 2022 as repairs and maintenance are expected to lower than the previous 2 years

CIBC Wood Gundy

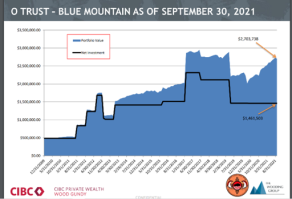

The graph is a blend of all funds held by CIBC in the Business, Investment, and Long Term Growth Fund

Since inception, the Trust first put money towards the Long Term Growth Fund around 2011 as the Trustees knew the path forward would be to utilize the growth of the LTGF. After 10 years after inception, the LTGF is accessible to allocate for Business Fund use. With the Trustees considering a new strategy, these funds will be discussed further to fund the idea of investment properties.

But to provide a sense of the growth, $500k was the starting amount, keeping in mind half of it was Savanna Shares converted to a mutual fund investment at the time. The book value is $1.4 million (what we put in) and with growth it is now worth $2.7 million

2020 Audit

In 2020, the Miikowap Business Development Corp became the primary business of focus along with all the CIBC investments, total revenues for the Trust were $48k. NCSG as income partnership was listed as nil due to poor performance in the region including COVID19. Miikowap was impacted slightly due the nature of COVID19, tenants were relieved of half there rent for a few months in the highest times of restrictions.

The usual expenses were kept to a minimum totaling $180k which is $40k less than 2019. Most of the decrease in expenses was in travel, the Trustees look to maintain the low travel costs for meetings and keep them local to the Nation.

With the all the challenges of the past couple years and limited investment options, the Trustees are please to have provided $7,489 distribution to Council on behalf of the beneficiaries of the Onihcikiskowapowin Business Trust. Since inception, the Trust has distributed $1.741 Million as part of purpose to create an income for the medium to long term

2020 AGM

Community Report

Year in review

2019

2019 was an eventful year for the Onihcikiskowapowin Business Trust. Much of the activity started in 2018 when the Trustees approved the creation of Miikowap Business Development Corp. (Miikowap) and the dissolution of the Savanna Energy Services Limited Partnership #7 (SESLP7).

SESLP7 was a valuable journey for many years which started in 2003 as Western Lakota Limited Partnership (50/50 partnership); merged with Savanna Energy Services Corp in 2006. In 2017 Savanna was bought by Total Energy Services and it was not a positive outlook. The Trustees decided liquidation of assets (after considering a few options) was the best option. The sale of the assets occurred in early 2019 and the partnership dissolved. The Trustees are considering investment options with the balance of funds.

On Behalf of the Trustees, I would like to thank all those in Savanna that were committed to the development and business growth of our Drilling Partnership.

SLCN/NCSG/OTrust Partnership in recent months has had to deal with COVID19, however there was very low work opportunities in recent years and looking forward in 2020, there are no major projects in our business area. If you are one of our community members who may be aware of crane & heavy haul business opportunities, please forward the opportunity to the Trust Manager so that we can make the most of the opportunity. We have a scaled pay range that works in favour of our community if we can make the appropriate arrangements.

Miikowap is a new entity created January 2019. The original purpose was to rent to our students and referral patients in Edmonton. There are some challenges in fulfilling the original purpose, however Miikowap purchased a fourplex in the Westmount area of Edmonton. Miikowap will continue to pursue the original purpose. The property has rented to members of our community since the summer of 2019. Please feel free to contact the Trust Manager for more details on availability. Images below.

Financial Update

2019 was an exciting year for the Trust. The first time in 5 year there has been a distribution to SLCN, the 2019 distribution was $82K. The total distributions since 2007 now exceed over $1.7 million.

The financial burden of depreciation on the assets of SESLP7 (non-cash item) that depleted any opportunity of making a profit for the Trust has been removed as an asset. The Trust is required to distribute 10%-20% of taxable Net Income, and we’ve had many losses due to SESLP7. Historical information on the Distributions are noted below.

In 2018, SESLP7 had an adjustment (impairment) to value of $1.2 million – resulting a loss of $1.3. In 2019, the assets of SESLP7 were sold which off set the losses; the result was more income for 2019 and larger distribution than expected.

SLCN/NCSG/OTrust which is a partnership that was created in 2014 that has been impacted by the decline in the energy industry, steadily declining income in previous years $70k & $34k for 2018 & 2019, respectively.

We do receive a bigger benefit for SLCN if we can identify work for NCSG. Please advise if you know of opportunities for Crane & Heavy Haul within our business Territory that spans from our Nation towards Edmonton down to include Hardisty.

Looking Forward

The Trustees always focus on investing in our community, The

Trust has the flexibility to lend money to our entrepreneurs and Band entities. Some key requirements would be to have a comprehensive business plan. An application Fee of $200 or 1% if the

borrowing request exceeds $200,000 can be expected.

The Trustees have a few considerations of business opportunities that can create local jobs, the Trustees have the power to create businesses should they need an entity to complete the opportunity, Miikowap is an example of following through such an opportunity. If you are interested to hear more about the Trust and how beneficial the model is to our community, Contact the Trust Manager Leith Cardinal.

|

||||||||||||||||||||||||||